-

FRANCE 24, The F24 Interview

With Annette Young, about the current developments of the crisis.

-

IGNORING LESSONS LEARNT

My most recent column in the French daily paper Le Monde : Le risque systémique court toujours. As usual the translation is due to Bénédicte.

Lehman Brothers’ bankruptcy, on September 15, 2008, and its aftermath – more than one trillion dollars being injected into the financial system – have caught people’s attention about…

-

My lecture at the Zermatt Summit, on the 16th of June 2011

Now online.

I defend my proposal of a prohibition of wagers on the evolution of prices (which was standard in the 19th century) within the framework of a Constitution for the Economy.

-

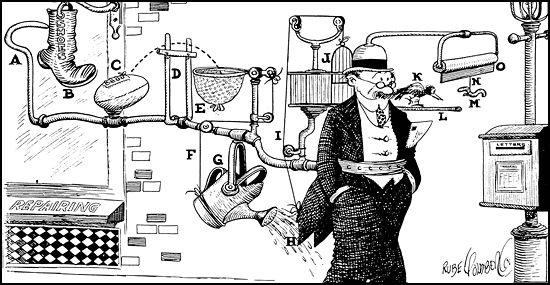

Healthy / destructive system of capitalism (2d version), by Lambert de Haas

Guest post. Taking advantage of my interview with Caroline de Gruyter in NRC Handelsblad, Lambert de Haas has put this all together. He’s expecting your remarks to make further improvements.

-

Capitalism’s highs and lows

I was asked to make the introductory speech at the Conference “Heurs et malheurs du capitalisme”, which took place at Université Blaise Pascal in Clermont-Ferrand on February 4th. Bénédicte has been so kind as to translate the written version of my speech.

Capitalism’s highs and lows? When we talk these days of its highs,…

-

One-Day Conference : Anthropology of the Crisis of Contemporary Capitalism, Paris, May 3d 2011

International Study Day

Anthropology of the Crisis of Contemporary Capitalism

3 mai 2011, 10h-17h, musée du quai Branly, 37 Quai Branly, 75007 Paris, Cinema Theater

Convened by Jonathan Friedman (IRIS/EHESS) & Laurent Berger (LAS/MQB)

Programme

10h-10h15 Jonathan Friedman (IRIS-EHESS) & Laurent Berger (LAS-MQB) « Introduction: Towards an anthropology of the crisis in capitalism »

10h15-11h Paul Jorion …

-

LE CAPITALISME À L’AGONIE, Fayard 2011

A couple of weeks ago, my new book Le capitalisme à l’agonie came out, published by Fayard in Paris. Bénédicte has been so kind as to translate the summary I wrote for its backcover.

Le capitalisme à l’agonie (Fayard 2011). Summary

In 1989, at the fall of the Berlin Wall, capitalism was triumphant. Deprived…

-

The mirage of a pluridisciplinary “science” of economics

This is a translation (by Bénédicte Kibler) of my most recent monthly column in the Economy supplement of the French daily Le Monde: Le mirage de la pluridisciplinarité.

Robert J. Shiller, professor of economics at Yale University, has published recently, along with his wife Virginia, a psychologist, an article entitled “Economists as…

-

Capitalism (I) – The Veins of the Future

An English translation of Le capitalisme (I) – Les nervures de l’avenir posted on my French blog on March 2nd.

In Reason in History (1837), a posthumous work composed from lecture notes, Hegel observes that “ … what experience and history teach is that peoples and governments have never yet learned from history, let…

-

What have anthropologists to tell about the subprime crisis that no one else has said before?

Finance is in shambles. It has remained until now under the close supervision of economic and financial theory. In recent years, due to the overbearing dominance of views developed under the umbrella of the “Chicago School” of economics, finance has been regarded as explainable through the combination of a very simplified version of psychology: that…

-

Where this blog stands

Various commitments on papers commissioned in French have kept me away from this blog. Reward is another factor: with an average of around 30 daily hits on the English blog and 2500 on the French one, vanity has been a powerful drive for concentrating on the French one. Dialogue is another one. If you’ve had…

-

Would an interruption of the Gulf Stream be reversible? And if so, at what cost?

I’m blessed with a very popular blog in French. One of the questions that came up lately in my dialogue with commentators is that of the reversibility of major ecological disasters induced by human activity and of the feasibility of reversing such disasters with the tools pertaining to our current technology.

This is a serious…

-

The cunning of Reason

The very justification of a Human Complex System’s approach to the operation of human societies, implying a continuous explanatory spectrum from the individual (particle) to the cultural or societal levels (field), is offered by Hegel when he writes in Reason in History (*) that

… human actions in history produce additional results, beyond their…

-

A population dynamics approach to the subprime crisis

One way of looking at the subprime crisis – and by this I mean only the properly real estate–based part of the unfolding drama – is in terms of population dynamics, in terms of three populations of borrowers who first entered the market and then left it in reverse order as the last to come…

-

The reasoning artificial toddler

I was interviewed earlier today by Richard Adhikari, a journalist at TechNewsWorld, about an Artificial Intelligence project. I didn’t know anything about that project except what would be the title of the article: “AI Program Thinks Like a 4-Year-Old”.

There is an excellent summary of what I had told the journalist:

“I’m always…

-

The end of trust in the subprime crisis and how to model it

The subprime crisis is often explained in terms of trust: one day trust between financial counterparties vanished and here was a crisis. Explanations in terms of “market confidence” refer in fact to two distinct phenomena, one being indeed trust and the other one being more plainly straightforward profitability. Let me start with profitability. Subprime loans…

-

The subprime crisis at UCLA

I’m happy with the way things worked out yesterday, March 8th, at the UCLA Complexity Science Conference with my paper: The Subprime Crisis: A Human Complex Systems Phenomenon.

Of course, trying to squeeze the whole crisis into an hour (1 ¼ with John Bragin’s express permission), it turned out I had much too much…

-

Pricing models: why the good ones are useless and the true ones, priceless

I’ve mentioned already in Agents using financial models and the “human cognitive cocktail” a number of pitfalls linked to the task of modeling the subprime crisis in a Human Complex Systems perspective, especially those related to agents’ partial understanding of the models they’re using or in errors they’re making when using them. I’ve…

-

Agents using financial models and the “human cognitive cocktail”

I’m working on the paper to be given at the Human Complex Systems’ one-day conference on March 8th. I don’t want to divulge prematurely any scoop but at the same time I’d like to share some of my puzzlement as I go, and as if thinking aloud.

Next Page

←Previous Page

←Previous Page