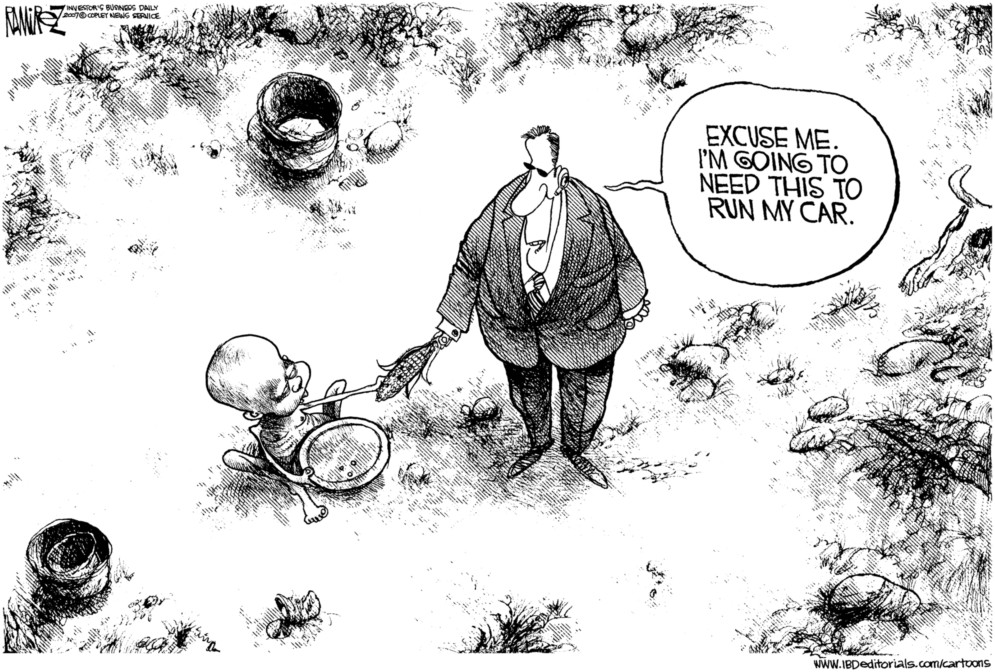

Réunis le weekend dernier, les congressistes de la Banque Mondiale et du Fonds Monétaire International, ont attribué une part de la responsabilité des émeutes de la faim qui ont éclaté en Egypte, au Cameroun, en Côte d’Ivoire, au Sénégal et en Ethiopie, à la politique américaine de promotion des carburants biologiques à partir du maïs et d’autres céréales. Le ministre indien des finances, Palaniappan Chidambaram, a déclaré : « Quand des millions ont faim, transformer des aliments en carburants biologiques constitue un crime contre l’humanité ».

« Excusez-moi, je vais avoir besoin de ceci pour ma voiture ». (Michael Ramirez, Investor’s Business Daily).

4 réponses à “Tout ne va pas si mal”

Je m’étonne quand même que, depuis le temps que l’on en parle, personne de « sérieux et important » n’ait entrevu le début du commencement d’un problème.

Je me souviens avoir lu un article dans Scientific American à propos de la voiture à hydrogène et il ne s’était pas écoulé un mois avant que je n’entende une critique argumentée sur une radio belge (si ma mémoire ne défaille).

A-t-on jamais calculé ce qu’il faudrait de surface cultivée pour fabriquer assez de carburant pour faire fonctionner les engins agricoles pour la cultiver ?

J’ai quand même l’impression (call me Mr Pessimistic if you like) que les « grands » de ce monde sont comme cet homme dans l’histoire qui répète : « me voilà au niveau du 15e étage, jusque là tout va bien. »

yvon henel,

La voiture à hydrogène (intermédiaire énergétique pour le moment) c’est pas tout à fait pareil que les bio carburants (du bio solaire à court cycle, en fait). Mais c’est courant de confondre source d’énergie et vecteur-stockeur d’énergie. Dommage que les quelques notions de thermodynamique et de bilan énergétique de base ne soient pas plus répandues.

Et si le problème considéré n’était pas le bon ? Ou plutôt s’il n’était qu’un aspect d’un problème plus vaste ?…

Esquisse de clarification des questions ci-dessus…

À votre avis, pendant combien de temps encore la population mondiale va-t-elle pouvoir doubler tous les 30 ans ?

Pendant combien de temps encore allons-nous nous voiler la face et pratiquer la politique de l’autruche en prétendant que cette augmentation exponentielle n’est pas un problème (« Croissez et multipliez ! ») et que l’on va trouver des solutions pour loger et nourrir tout le monde ?

Pendant combien de temps l’agitation dans le bocal Terre va-t-elle continuer d’augmenter en raison de l’accroissement de la pression démographique avant que la vie n’y devienne invivable ?

Ou quand l’instinct de survie des uns, toujours plus nombreux, commence à entrer en conflit avec le mode de vie des autres…

Atteindrons-nous jamais un équilibre, ou sommes-nous a contrario condamnés à l’auto-destruction ?

Ce serait un peu long à traduire mais c’est pertinent.

Wall Street Grain Hoarding Brings Farmers, Consumers Near Ruin

By Jeff Wilson

April 28 (Bloomberg) — As farmers confront mounting costs and riots erupt from Haiti to Egypt over food, Garry Niemeyer is paying the price for Wall Street’s speculation in grain markets.

Commodity-index funds control a record 4.51 billion bushels of corn, wheat and soybeans through Chicago Board of Trade futures, equal to half the amount held in U.S. silos on March 1. The holdings jumped 29 percent in the past year as investors bought grain contracts seeking better returns than stocks or bonds. The buying sent crop prices and volatility to records and boosted the cost for growers and processors to manage risk.

Niemeyer, who farms 2,200 acres in Auburn, Illinois, won’t use futures to protect the value of the crop he will harvest in October. With corn at $5.9075 a bushel, up from $3.88 last year, he says the contracts are too costly and risky. Investors want corn so much that last month they paid 55 cents a bushel more than grain handlers, the biggest premium since 1999.

« It’s the best of times for somebody speculating on grain prices, but it’s not the best of times for farmers, » said Niemeyer, 59. « The demand for futures exceeds the demand for cash grains. »

Commodity investors control more U.S. crops than ever before, competing with governments and consumers for dwindling food supplies. Demand is rising with population and income gains in Asia, while record energy costs boost biofuels consumption, sending grain inventories to the lowest levels in two decades.

Fund-Buying Gains

Index-fund investment in CBOT corn, soybeans and wheat has increased 66 percent to the equivalent of 902,105 futures contracts, a record, since January 2006, when the government began collecting the data. Each contract represents 5,000 bushels, about what Niemeyer reaps from every 22 acres of corn planted.

Investments in grain and livestock futures have more than doubled to about $65 billion from $25 billion in November, according to consultant AgResource Co. in Chicago. The buying of crop futures alone is about half the combined value of the corn, soybeans and wheat grown in the U.S., the world’s largest exporter of all three commodities. The U.S. Department of Agriculture valued the 2007 harvest at a record $92.5 billion.

Commodities are in their seventh year of gains, with oil rising to a record $119.90 a barrel on April 22. Copper and gold reached their highest prices ever this year, and rice has more than doubled in the past year to $24.18 per 100 pounds.

Crops and raw materials have « become an asset class that institutions use to an increasing extent, » billionaire George Soros said April 17. « On top of that, you have specific factors that create the relative shortage of oil and, now, also food. »

Food Riots

Surging food costs have sparked protests and riots in countries including Haiti, Indonesia, Mexico and Egypt. Rice, corn, soybean and wheat prices have climbed to records this year, partly because of droughts in Australia, a freeze in Kansas and increased demand for livestock feed.

The divergence between CBOT futures and the underlying commodity is so great that some grain merchants have stopped bidding for new crops, said Niemeyer, a member of the National Corn Growers Association board. Others won’t guarantee a price for more than 60 days.

« We have a fundamental problem with the markets, » said Kevin McNew, president of researcher Cash Grain Bids Inc. in Bozeman, Montana, and a former Montana State University economist. « It is very difficult to operate a grain business when the cash prices are below the futures » by such a wide margin, he said.

The price gap should converge when futures contracts expire and deliveries are settled. Instead, the average premium for CBOT wheat has quadrupled in two years to 40 cents a bushel, compared with 10 cents the prior five years, McNew said.

Demands on Capital

The grain rally also is boosting costs for grain processors including Archer Daniels Midland Co. and Bunge Ltd.

« A volatile, high price environment presents some challenges, » Alberto Weisser, chief executive officer of White Plains, New York-based Bunge, said during an April 24 conference call. « It creates demands on working capital and leads to inflationary pressures that can influence national policy decisions. »

In its April 24 earnings report, Bunge’s margin deposits, mostly used to hedge grain on the CBOT, rose fivefold to $188 million in the first quarter.

Companies have increased debt to finance more expensive inventories, said Judi Rossetti, director of corporate finance for Fitch Ratings in Chicago. Without a reduction in debt, grain processors may need to sell shares to raise cash, or corporate debt ratings may be reviewed, Rossetti said.

Not Worth Risk

For James McReynolds, who farms 2,000 acres of wheat outside Woodston, Kansas, futures aren’t worth the risk.

« The differential of what the market should be and what you can actually sell is so far out of line that you aren’t willing to do it, » McReynolds said. « This is a tough situation. Agriculture is not as healthy as we’d like to think it is. »

Wheat jumped to a record $13.495 a bushel in February, twice the level of a year earlier, only to fall 15 percent in March, the biggest monthly decline since 1997. Volatility in corn futures jumped to almost 41 percent in March, up from 23 percent a year earlier, data from the exchange show.

The increased risk boosts the cost of buying grain.

Michlig AgriCenter Inc. in Manlius, Illinois, a grain handler with 6.5 million bushels of storage capacity, often buys crops before they are produced and uses the CBOT to manage its price risk. The cost to set hedge positions for corn delivered in December, after the harvest, is three times higher than a year ago, said Scott Stoller, a Michlig grain merchandiser.

Dell Princ, 51, general manager at silo owner Midway Cooperative in Osborne, Kansas, said the monthly interest to finance his hedges tripled to $150,000 in the past year as the exchanges in Chicago and Kansas City demanded more money to cover any potential losses on his positions.

The additional expense can add 15 cents to 40 cents a bushel to the cost of handling wheat, compared with 5 cents to 10 cents on sales in years past, he said.

« The interest costs eat profits, » Princ said.

To contact the reporter on this story: Jeff Wilson in Chicago at jwilson29@bloomberg.net

Last Updated: April 28, 2008 01:00 EDT