Le texte de la leçon inaugurale de la chaire « Stewardship of Finance », que j’ai donnée à la Vrije Universiteit Brussel, le 4 octobre 2012.

Why Stewardship of Finance?

When in the Autumn of 2011 I was first approached by Michel Flamée on behalf of the Vrije Universiteit Brussel about the chair I’m privileged to speak from today, the question of how it would ultimately be called was still undecided. The Flemish phrase used in the early discussions was “ethisch financieren”: financing in an ethical manner.

“Ethical finance”, “responsible finance”, “sustainable finance”, so many different phrases have been used to name chairs with similar intent as this one. The difficulty I see however with such ways of speaking is that they have been used in the past sometimes as mere euphemisms when referring to investors in search of a good conscience in the choice of an investment out of a mere concern for political correctness.

Generally speaking, “ethical”, “responsible”, “sustainable” finance, all refer to finance as an entity which can be qualified one way or other, that is, its actual meaning being restricted in scope through adopting a particular perspective when examining it. That seems to suggest that left to its own devices finance as such will never be acceptable but can be brought into submission if restrained in a sufficient degree. The question of what finance actually is, how it operates and how it fits into the global societal setup is then conveniently left in the dark.

What if finance itself had something to say about how to present its actual role within society as a whole? When I say “finance” I have in mind of course the practitioners embodying it. Before it became an economic sector in its own right, trading in a commodity called “money”, and most prominently nowadays, acting as the bookmaker for bets on price fluctuations, when not betting itself with the highest possible leverage, finance was, in a way similar to mathematics being the servant of the sciences, the servant of the economy, providing it with its bloodstream. What if finance came up now with a view of its own on how it should perform the tasks specific to it instead of claiming independence and running affairs (ours as well as its own) as it sees fit and in need then of being tamed, subdued one way or other, in order for us in the community to benefit from its operations?

* * *

When back in 1997 I was awarded the Regents’ Lectureship at the University of California at Irvine I was given for the first time in my life the opportunity of spending in the United States more than a couple of weeks at a time unlike what had been the case in all previous instances. Many aspects of American cultural life had intrigued me over the years and I had been waiting for a chance to get a further and deeper acquaintance with them.

While my stay was initially planned to last three months only I ended up living in the Unites States for twelve years and the list would be too long and too irrelevant here of the singers and musical groups I was delighted to attend the concerts of during that period, making up for too many missed opportunities in the past.

One thing I had become aware of while studying American history was the inordinate political influence which had had over the ages a very small group of persons: the Quakers, or “Religious society of friends” as they prefer to call themselves.

Quakers are an English radical seventeenth century protestant splinter group whose members have taken to some extreme the notion of a direct relationship to God allowing them to dispense altogether with a priesthood. This being said, my own acquaintance with California Quakers has convinced me that a vast majority of them nowadays are truly unadulterated atheists, some of them being even stridently outspoken on the subject, despite the word “religious” being part of the name of their denomination.

Quakers have been known for spearheading abolitionism in the period leading up to the American Civil War and in more recent times for their uncompromising pacifism. The contemporary ecological movement has found a major part of its inspiration in Quakerism and the so-called “de-growth” current of the ecological movement in Europe is the descendant in a direct line of Quakerism notwithstanding the fact that the European representatives of that current seem surprisingly unaware of this particular strand in their ancestry.

It is at the Quaker meetings I attended in the years 1997-2002, at Costa Mesa, Santa Ana, Pasadena and Claremont, in Southern California, that I first became familiar with the concept of stewardship, that of the service to the community, which Quakers regard as being the true relationship which should exist in the same exact manner between the single individual and the overall community of Friends, and between the latter and society at large.

The interest which had led me to the Quakers was that of the anthropologist as an “Observer of Man”, referring here to the name of the first French anthropological society born in the year 1799 and deceased in 1804, curious about the variety of human expression. The truth is that I found among them friends up to the standard which their self-assigned label suggests. Please allow me in that respect a quick tribute to the memory of Evelyn Smith Munro who, along with my parents, would have been so proud seeing me here today. At the time Evelyn died I devoted to her a post on my blog entitled “Quand il est légitime de chanter la Marseillaise”. There is an entry on Evelyn in the Encyclopaedia of the American Left.

* * *

Before I delve into the details of what financial firms actually do, let us pause and wonder what they should be doing. In September 2009, Lord Adair Turner, head of the Financial Services Authority, the British regulator of financial markets, although not being specific about what they do stated that whatever financial firms do should be “socially useful”. His remarks sounded particularly topical at the time as the memory was still fresh in all minds of the financial debacle which had taken place in the aftermath of the default of the Wall Street investment bank Lehman Brothers, when the money market, the American market for short-term debt products collapsed, at a cost adding up to somewhere in the region of one trillion dollars, an amount not heard of before.

Lord Adair’s remarks were received with but moderate enthusiasm by the financial establishment as it was all too self-evident at the time that if the “socially useless” (not to mention the plainly “obnoxious”) activities of their sector were not directly responsible for the recent disaster, they had at least contributed in a major way to what had become its very size.

Generally speaking, having in mind now all types of businesses, the activities of a firm which are socially useful are those satisfying the needs of its patrons and employees, with the immediate qualification of course that the needs of these patrons should themselves be socially useful. And here lies right away one of the considerations cropping up classically whenever “ethical finance” is mentioned: that the activities of some firms are either socially useless or sometimes even worse, being straightforwardly socially harmful. A service therefore which an investment fund can render a potential investor is assessing the social usefulness of businesses in quest for funds.

British insurers were recently faulted for a related reason: while they would perform due diligence when investing in a particular firm’s returns, checking in such instances for environmental and social risk associated with the activities of the firm, they would fail to do so whenever they were investing in a fund, trusting without further inquiry that it would have at heart performing its own due diligence. The code to which British insurers should have complied but failed to do so apart from one, is aptly called the UK Stewardship Code.

Greed is no doubt a powerful drive for many of our fellow-human beings, and one may claim that it is so pervasive a drive that a type of activity fulfilling it is therefore in its own kind of way “socially useful”, like one may similarly claim for, let’s say, prostitution. But this only emphasises the necessity of calling in ethics as the relevant analytical framework whenever assessing such issues.

Greed in indeed a drive without being for that matter a need properly so-called. As will be remembered, in the original 1987 “Wall Street” film, the character of Gordon Gecko, played by Michael Douglas, was asserting that “Greed is good!” The aim of the film’s director, Oliver Stone, was to decry such claims and the value-system underlying them. The character of Gecko was a chimera composed out of several personalities whose words in different occasions were borrowed by the film’s scriptwriters. Prominent among them was Ivan Boesky, the infamous arbitrageur and inside trader who had once declared: “Greed is all right by the way. I want you to know that I think that greed is healthy. You can be greedy and still feel good about yourself” (Bailey 1992: 137). Other components of the Gecko character were corporate raiders Carl Icahn and T. Boone Pickens, as well as Nobel Prize awardee Milton Friedman. While the first figure in that list is to everyone’s opinion a despicable criminal, the other three are revered as heroes in the business milieu, calling our attention to the fact that notions like “ethical finance”, “responsible finance” or “the stewardship of finance” for that matter are not necessarily unanimously approved within the financial community and that their very pursuit may be considered by some as essentially “anti-business”. A most prominent stream in the economic and financial community has openly proclaimed that any concern of a “social” nature is akin to “totalitarianism”, a word often used as a euphemism for “communism” exclusively, as representatives of that school, many of them recipients of Nobel Prizes in economics, have shown themselves besides, as we will see, very lenient indeed, if not openly sympathetic, towards other brands of “totalitarianism”, such as dictatorships reminiscent of fascism or national-socialism.

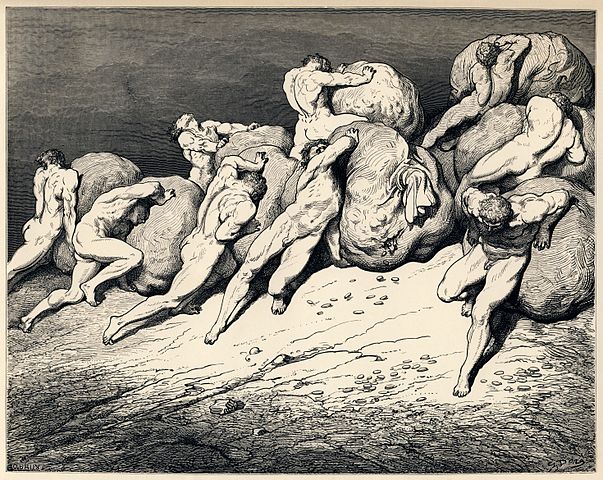

Thus greed is far from being universally condemned within the financial community and for lack of unanimity here, some additional criteria are needed to distinguish between a well-distributed trait such as greed from a “useful” disposition. Greed is as everyone knows one of the seven deadly sins and if Dante’s depiction of the fourth circle of the Inferno were more familiar to the financial community than is currently the case, things might be very different, but the notion of sin is of a religious nature and our lay world is that of the “rational” homo oeconomicus, I mean “rational” in the economists’ definition of the term which is quite remote from what you and I understand under that word in normal circumstances.

Dante Alighieri’s Inferno, illustration by Gustave Doré

Whatever the case, such considerations underline on the face of it that the definition and promotion of the homo oeconomicus, the self-centred “rational” human being, has by itself side-lined the issue of ethics and morality as extraneous to finance and possibly to the economy as well and is therefore in need of justification when considered in relationship with finance or with both fields. The time has gone when ethics and morality were conversely regarded as the set framework within which any human action – of a financial nature included – would necessarily be assessed. This in itself may be revealing about the fabric of the times we’re living in as of now.

Hegel emphasised that a civilisation enters in decadence when private interest prevails over the common good. Maybe the conversation we’re having here today about the “stewardship” of finance and our observation that the notion will spontaneously sound to most within the financial community as extraneous to the field is telling us more indeed than we would like to hear about what is the true essence of our times.

* * *

It goes without saying that the “social” in the phrase “socially useful” cannot mean that the community as a whole will benefit in every instance of a financial deal. Even if we do not express it usually as explicitly as in the manner I will do now, a “socially useful” financial activity should not contribute in my view at amplifying the concentration of wealth that the logic of profit and the payment of interest fuel as part of a recurrent process in our societies. In other words, “social” necessarily implies an element of fairness in treatment which may be otherwise absent from the way our economy and financial systems work as they not only allow an unbalanced distribution of wealth but also contribute at unbalancing it even further as any privilege acquired comes with a potential for snowballing. The end result is at one end of the spectrum the concentration of wealth in very few hands, while the vast majority, the so-called “middle classes”, have witnessed over the past forty years a most uncomfortable thinning of their wealth.

What I’m saying here would need to be further developed in the manner I am offered when I write books. In any case, if what I’m saying about the contradiction existing between “socially useful” and wealth concentration is welcome the implication is that any financial activity whereof the only aim is to confiscate as large a part as possible of new wealth created will not qualify as “socially useful” and in particular activities which are nothing but bets on prices’ fluctuations, as is the essence of what we call “speculation”.

But a definition such as I just gave that is not “socially useful” what contributes at further concentrating wealth implies as I noted in passing that the payment of interest constitutes as such a hurdle to that effect as it makes it so that whoever is in a position of lending and has therefore more wealth in his possession than he requires to fulfil his immediate needs will end up at maturity of the loan to possess even more of that wealth. Religions like Christianity or Islam have been very much aware of such inconvenience and hold a principled view on this issue. All the same, alternatives to rewarding a loan with interest are not easy to come by as there exists some objective foundation to interest payment: the self-evident advantage of immediate as opposed to delayed access. The familiar saying: “a bird in hand is worth two in the bush”, encapsulates the notion. Deprivation is a disadvantage requiring compensation and asked at what price I will rather accept a 100 € bill in a week time than one given me right away I will not hesitate indeed quoting a price.

There exists however in my view a way out this quandary. I’ve expounded it in my book Le capitalisme à l’agonie (2011): it requires distinguishing on the one hand, loans aimed at creating new wealth, in which case the interest paid is but a share of the newly created riches and, on the other hand, loans whereof the only purpose is to meet a current lack of resources – for an individual or a household usually. In the first instance, the riches which interest constitutes has been created alongside in the productive process and the payment of interest is justified – as long that is that the principle of private property is not itself being questioned. In the second instance, no new wealth has been created, just an immediate need fulfilled, the payment of interest is then in my view unjustifiable; lending with the purpose of ensuring subsistence should be regarded as a way for addressing community needs and should be provided as a public service sheltered from any logic of profit.

* * *

I’ve been leading a personal crusade against speculation since 2007 and I’ve seen myself opposed time and again by some of its enthusiastic supporters whose favourite argumentative tactics when defending their pet endeavour is that speculation can in no way be harmful because it is so prevalent a thing that only a fool would ever consider forbidding it. Isn’t buying a house, they say, and hoping its resalable value will go up rather than down, speculation? Isn’t hoping one’s children will succeed in life speculation? And so on, you just name it!

My answer to that is straightforward: speculation was forbidden in Belgium until 1867 and in France until 1885. The laws forbidding speculation were easily understandable as their principles were transparent. Only three articles of law were needed in France: two pertaining to penal law, one to civil law. Interpretation by courts would notoriously vary, depending on how sympathetic these would be to the business milieu’s claims that speculation is highly beneficial as “it provides markets with liquidity”.

I need to immediately add that despite the prohibition of speculation during the first three quarters of the nineteenth century, ordinary citizens were still fully free to buy houses or send their children to school in order to improve their skills through education.

The word “liquidity” refers to the ease with which whatever is not money can be turned into money. The higher the number of actors on a market the higher the likelihood that a commodity will find acquirer, that is, will be exchanged for money. But that very simple principle applies in the same manner to any buyer or seller, whether commercial, speculator or even criminal: anyone prepared to either buy or sell is adding to a market’s liquidity out of logical necessity, no need therefore to be a speculator! The implication is that in order to be judged “socially useful” a firm cannot content itself with providing evidence that it buys and sells, this being trivial, as its purpose for doing so may possibly be only to extract value and nothing else.

A speculator has no interest per se in the commodity traded: his sole concern is selling at a price as much higher as possible than the price at which he has purchased. He will therefore go to great lengths trying to make prices move up through the development of an upward trend – this explaining why “speculative” prices may settle at very unlikely levels, independently of the nature of the commodity and of the presence of a need for it in the community. Futures’ markets by allowing to sell before one buys, have made it possible to bet on the price of a commodity plummeting instead of rising, so that trend development may be beneficial to speculators whether going up or down.

Bets on prices’ variations embody aptly the essence of “socially useless” financial operations. What betting bank A loses, betting bank B will reap the benefit of. Until that is luck reverses course. This would all be quite innocuous if the gains and losses of A and B only impacted one of the two – apart of course from the risk that either A or B having lost its bet turns out to be insolvent and spreads systemic risk across the financial system as a consequence of its default. Financial bets impact in fact the economy as a whole: “spot” prices, those generated when buyers meet producers on a primary market, end up getting aligned on the speculative prices of futures’ markets on the misguided assumption by traders that prices quoted on a futures’ market give an indication of what future prices will turn out to be, and this despite the fact that currently actual producers and actual buyers of a commodity represent at most 20% of volume on futures’ markets.

We heard last August that the Austrian bank Volksbanken and the German banks Deutsche Bank and Commerzbank had ceased to sell their clients speculative financial products indexed on foodstuff. These three banks made it clear that their motive for pulling out of these products was not that speculation upsets the price formation mechanism but that public opinion’s perception that such is the case was sufficient motive. The fact that foodstuff’s speculators had been under the spotlight in the Summer of 2008 when food riots triggered by climbing grain prices erupted in Africa, Asia and in the Americas, is most probably not foreign to these wise decisions.

* * *

Let’s turn now to the socially useful functions of finance. I will mention the four main ones: intermediation, insurance and the operation of a primary market for debt instruments and the maintenance for their trade of a secondary market.

Intermediation, ensuring the meeting of one party needing funds with another party having access to funds which it is prepared to lend for a period of time as long as interest gets paid for the service rendered, is usually referred to as the “price discovery process”. The phrase is unexpected, a price will indeed get discovered in the process, although it will rather be a rate used for pricing than a price proper, but this seems somewhat incidental in view of what are the more salient events taking place: the discovery process of a would-be lender for a borrower seeking advances, followed by the exchange of an amount of money against a transferable promissory note or a non-transferable IOU.

Unexpected phrases prick up your ears, signalling a religion at work in the background and the anomalous phrase revealing inadvertently one of the sacrosanct dogmas of that religion.

For example, there is a famous financial textbook entitled: Foundations of Financial Markets and Institutions, signed by Frank Fabozzi, Franco Modigliani and Michael Ferri. It says at page 2: “Prices are the signals operating in a market economy that direct economic resources to their best use”.

Is this truly what prices are? “Signals”? I happen to have written a book on price formation entitled Le prix, that is, “Price”. Never once in that book do I refer to a price as being a “signal”. No: prices to me indicate a quantity of money which obtains in the exchange for money of a commodity or service, an amount expressing besides the current power balance between buyer and seller. Prices are signals according to only one particular brand of economic thought: Friedrich von Hayek’s. However here it stands: at page 2 of a renowned textbook.

What about then the “price discovery process”? Van Horne, author of another textbook: Financial Market Rates and Flows, writes: “The mechanism by which savings-surplus units come into equilibrium with savings-deficit units is known as the price discovery mechanism process” (van Horne 1994: 5), which is straightforward even if expressed in an unnecessarily convoluted way. But the same Fabozzi, Modigliani and Ferri’s textbook defines the “price discovery process” as “An economic function of financial markets that signals how the funds in the economy should be allocated among financial assets” (p. 16). “Signalling” again! Making a lender and a borrower meet to exchange money for a debt recognition is once again being branded as a “signalling process”, we’re still no doubt here within the confines of that same religion.

Intermediation is thus the process by which financial actors, individuals, firms, municipalities, States such as the U.S.’ “states” or nations, in search of capital to borrow are being put in touch with those entities likely to provide them with funds. There are several means to such purpose that financial institutions can resort to: savings’ booklets, certificates of deposit, notes, bills, bonds, or simply through depositors’ checking accounts, a portion of these deposits being lent to borrowers on the basis of statistical assessments of how long such sums remain on an account before being withdrawn by the owner. Banks compensate themselves for the service provided through a beneficiary margin coming on top of their costs.

As far as insurance is concerned, it is the insurance companies’ size which allows them to perform a function of this type. The loss for instance for a renter of having set his apartment on fire exceeds in most cases by far his financial means. Due to their size, Property & Casualty insurers are able to manage such risks on a statistical basis: historical data are collected over the years about the occurrence of such events as fires and associated damages whenever they occur. An actuarial assessment by an insurance company in terms of average and maximum loss tolerable before insolvency allows the calculation of an insurance premium level which will not only cover for losses but will allow the company a profit. However costly individual fires may be, they become by this method collectively manageable as their individual occurrence remains at a degree of rarity which has been accurately assessed.

Life insurance operates from similar principles. Life expectancy rests however on simpler probabilistic assumptions than other types of damage. As for the investment part of life insurance, it is but a variety of intermediation between the insured and the issuers of the debt products in the insurer’s portfolio.

Finally, the third and fourth main types of financial activities which are unquestionably socially useful are in the operation of a primary market for debt instruments and the upkeep of a secondary market for them. A debt instrument or security is a title establishing acknowledgement of a debt, such as a promissory note or an IOU; are mentioned on the title, the agreed upon interest rate and the time-schedule for reimbursement and interest payments. A primary market is a market where a producer sells its products – issuance of debt or of shares is in that respect a variety of production. A secondary market is a market where such products can then be resold and rebought in principle forever until their life ends through consumption. In the case of a secondary market for debt instruments, the end of life of a product occurs when it reaches maturity: the pre-set time when it will be redeemed for money.

Bankers, and goldsmiths before them, have been prepared since the Middle Ages to trade promissory notes. In exchange for a discount on the face value of the debt instrument, the financier purchases the promissory note from its owner, the burden of obtaining payment at maturity becoming henceforth his own. The seller benefits from having gained immediate access to cash but suffers the inconvenience of a reduction in the amount he would have received had he waited instead for the promissory note to reach maturity.

The preparedness of financial firms to maintain such a secondary market for debt instruments has led to consider these as near-equivalents of money. Such equivalence is however more theoretical than real as it is conditional on the loan amount being reimbursed in fine, and the interest payments – if any – being thorough and timely. The equivalence between debt instruments and genuine money is for that reason particularly susceptible to economic circumstances.

I mentioned “liquidity” when examining the supposed contribution of speculators to a markets’ liquidity. Here also, the capacity of a debt instrument to be regarded as an equivalent for money and therefore to be readily translatable into cash through its purchase is called its liquidity. The “illiquidity” of debt instruments can result from potential buyers having temporarily lost as far as they are concerned, access to cash, most often however it is due to severe disagreement between sellers and buyers on what is a fair price for the product, potential buyers claiming in that case a higher discount reflecting in their mind the rising probability that reimbursement will fail to take place or, should it happen, only for a lower amount than face value (a process then called the “restructuring” of a debt). The illiquidity of debt instruments is a major cause of financial crises. The onset of the subprime crisis is generally regarded as having occurred in the early days of August 2007 when a fund-manager for BNP-Paribas stated that prices had ceased to be quoted for American Asset-backed Securities backed by subprime mortgages.

* * *

Nothing seems as self-evident to me personally than the notion that finance should be the steward of the economy – of the economy as a whole of course, not of some subset of it or of a specific group of individuals. Nothing is more foreign to the spirit of our times currently however than that notion of finance as a steward to the community. That spirit has been shaped indeed by the “science” of economics as it has been developing since the eighteen-seventies with the advent of the so-called “marginalist” revolution.

Think for instance of Prof. Milton Friedman (1912-2006), a Nobel Prize in economics in 1976, or should I say more appropriately a “recipient of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel”, who held that companies have no social responsibility and that their single aim is to be profitable for the sole benefit of their shareholders. Forget thus about their clients, forget thus about their employees: profit! “Profit”, Prof. Friedman claimed, is the only way to go!

In 1970, in a column for the New York Times, Friedman wrote: “There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud. »

The Economist weekly magazine, in Friedman’s obituary in November 2006 called him “the most influential economist of the second half of the 20th century (Keynes died in 1946), possibly of all of it”. In that light, in the light shed by a revered Nobel Prize in economics, the very notion of a stewardship of finance is nothing short of being revolutionary.

Or is “revolutionary” maybe not strong enough a word? It would seem so, if one goes along with what Friedman stated in his best-selling 1962 book Capitalism and Freedom (which sold over a million copies), where he claimed that the notion that firms have a social responsibility leads inevitably to… yes: totalitarianism. No less!

Milton Friedman’s good friend and one time mentor, Friedrich von Hayek (1899-1992), as far as he was concerned, held the phrase “social justice” to be “meaningless”. No doubt that Friedman himself would have regarded the notion of a “stewardship of finance” as undoubtedly “totalitarian”.

Friedman was awarded the Nobel Prize in economics in 1976, von Hayek had received his own two years earlier, in 1974. Both were at the time in the best of terms with Augusto Pinochet, the Chilean dictator. Friedman, once said: “Chile is not a politically free system, and I do not condone the system. But the people there are freer than the people in Communist societies because government plays a smaller role”. Hayek was even more outspoken as he said in an interview while in Chile: “Personally I prefer a liberal dictator to democratic government lacking liberalism”.

Had something gone seriously wrong with the Central Bank of Sweden awarding Nobel Prizes in economics in the early nineteen-seventies, that it would give the Prize to such self-proclaimed enemies of democracy? I personally believe so. And if the very notion of “stewardship of finance” would equate to “totalitarianism”, wouldn’t it be fair to find a name for the kind of opinions held by Profs. von Hayek and Friedman, especially since their views have found their ways into first-year economy students’ textbooks? Stephen Gill calls that brand of thinking « disciplinary neoliberalism » (Cutler p. 6), “disciplinary” being of course a courteous synonym for “dictatorial”. There is a rumour going around that on days I’ve been in a particularly irritable mood I’ve personally called this: “white collar fascism”, but “Hush!” it should remain a secret!

* * *

But how could things have possibly gone so wrong? Or are times like these very much behind us now? One might hope so and one might even think so: listen indeed carefully to the following:

« To accept the concept of virtue requires that you believe some ways of behaving are right and others are wrong always and everywhere. That openly judgmental stand is no longer acceptable in America’s schools nor in many American homes. Correspondingly, we have watched the deterioration of the sense of stewardship that once was so widespread among the most successful Americans and the near disappearance of the sense of seemliness that led successful capitalists to be obedient to unenforceable standards of propriety. Many senior figures in the financial world were appalled by what was going on during the run-up to the financial meltdown of 2008. Why were they so silent before and after the catastrophe? » (Murray 2012).

This excerpt from an opinion piece in the Wall Street Journal in July of this year sounds like nothing more than plain common sense, what makes it however remarkable is that its author is Charles Murray who, in case we didn’t know, reminds us further down into his column that he is a libertarian, in other words holds political views identical to Friedman’s and Von Hayek’s who, as far as virtue goes, held in high regards the opinion of their self-proclaimed forefather, eighteenth century’s Bernard Mandeville, who some time wrote in his Fable of the bees (1705) that « private vices are public benefits ».

What has happened in the meantime as everyone is fully aware of is the crisis which started in 2007 and has by now gone through several destructive phases. A number of certainties have been put to the test over the past five years and new ones are unfortunately tried every day.

As Professor Leclerc-Olive was early to notice (2011), virtues in everyday conversation have not been around all over the years: their spectacular return was brought about by the dramatic events of the Autumn of 2008. From that time on, the lacking virtues of financiers have been mentioned time and again and “moralizing finance” was called up as the ultimate panacea for all the evil which had just been witnessed.

Five years later it is difficult to imagine even that virtues had experienced an eclipse of such scale, having lasted for a full two and a half centuries. Such is however the case: Mandeville’s “private vices” have been praised and regarded as the way to go. Friedman, Hayek and before them Ludwig Von Mises (1881-1973) were only extreme cases of a commonly shared Weltanschauung.

What characterizes that Weltanschauung? That interference in the course of action of free individuals will cause more harm than good and that the epitome of interference is the intervention of the State.

There are in this view two ways wherein the human race has developed habits: unaware and deliberate. Anything which has arisen unaware is good – private property providing supposedly an unsurpassed example. Anything which was created intentionally – as supposedly the State – is bad. Morals and the law also are thus essentially bad unless that is they are put to the purpose of making sure that unhindered free behaviour is given the most adequate environment for its exercise. A good example of this being the competitive environment.

Competition allows each one of us to act in the exact way that he or she deems fit. However a free competitive environment requires maintenance. In the absence of upkeep its benefits will not obtain. Therefore a coercive legal framework is necessary to ensure the exercise of free competition.

What is the most appropriate term to describe what I’ve just said: “a legal coercive framework to ensure the exercise of free competition”? A contradiction in terms of course: the argument is undermined by a blatant contradiction: competition enforced by a coercive legal framework is necessarily “forced competition”, there is no way it can be “free competition”.

But this is no serious objection to the supporters of the competitive environment: according to them the contradictions of their adversaries are damning to the views these hold but their own contradictions are not: they are just the way the world happens to be, and that’s about it.

The view that people’s institutions that have arisen spontaneously are necessarily good while those that have arisen through deliberation are bad is somewhat surprising since there is such a premium assigned in mainstream economics to « rationality » which the homo oeconomicus, the ideal type of the free man, is supposed to fully embody. But, as we were already given the opportunity to observe, the rationality of the homo oeconomicus is not supposed to be exercised for the common good, only as a means towards fulfilling his own self-centred interest.

What is the purpose then of so much out of principle freedom for everyone? My hunch is that in a world where private property has been around for so long and has been condoned as one of those very few institutions which came around spontaneously, it offers equal freedom to all, just as in the familiar instance of the fox in the chicken coop.

A self-serving representation thus of the world for those who by now own it and wish to reap unhindered the benefits of their privileges. Another way for expressing the same is to notice that this Weltanschauung promotes a world ruled by an aristocracy of money on the exact same pattern as feudalism promoted a world ruled by a landed aristocracy. Von Hayek for one came very close to saying this explicitly.

That representation is by now in deep trouble. The self-regulation hypothesis underlying the whole construction was disconfirmed by facts in the most recent five years.

* * *

A fraudster is aware of certain prohibitions and determines that he will ignore them wilfully. By doing so, he or she breaks the law. When we toy with a notion like “ethical finance” we assume that we could possibly persuade a fraudster to abstain from breaking the law and that were our efforts sufficiently sustained, the operation of finance would change globally for the better.

We could alternatively do away with persuasion and put the emphasis instead on enforcement. We are talking here about regulators, about the operational means at their disposal, about their determination in the pursuit of crime, their competence in a world where business is in a position to offer the able higher wages than the civil service can, also of the power balance between supervisor and supervised party.

Thinking of the current crisis, some analysts have offered interpretations of its inception in terms of fraud essentially, some others, have emphasised a faulty environment. I belong personally, as some of you may be aware, to the second kind. Similarly, having in mind a prior crisis, that of the American Savings & Loans which plagued the United States in the late nineteen-eighties, the standard interpretation of it is that of a crisis due mostly to the misguided practice by such lending bodies of refinancing long-term loans on a short-term basis, a strategy necessarily doomed when an inverted term structure appears where long-term interest rates drop below the level of short-term ones, a situation which developed indeed in those years.

In normal circumstances, a lender is not only rewarded with interest on a pro-rated basis according to time, but the interest rate itself is higher if the lending period (the maturity) of the loan has a longer duration. It makes therefore financial sense for a lender to lend long-term, let’s say for ten years, and refinance himself on a short-term basis, let’s say every three months. But when for circumstantial reasons the term structure of interest is inverted: with short-term lending being more highly rewarded than long-term, a strategy of this type becomes self-defeating – which happened in the late nineteen-eighties and brought the Savings & Loans’ downfall.

Such is the standard explanation of the Savings & Loan crisis, provided for instance by Franco Modigliani, Nobel Prize in economics in 1985 (Fabozzi & Modigliani 1992: 93-95). This notwithstanding, one William K. Black, a prominent actor on that scene at the time, on the regulators’ side, has propounded, in a book entitled The Best Way to Rob a Bank Is to Own One (2005) an explanation of the Savings & Loans’ crisis, in terms of fraud only.

My issue here is neither to determine which of those two hypotheses is correct or to allocate responsibility between individual fraud and faulty structures but to highlight that particular issue of error behind and beyond that of fraud. The fraudster breaches the law wilfully, while the incompetent makes an error unintentionally.

Let us imagine that fraud has been one day fully eradicated through reform of the sinner so that the concern for ethical finance has lost forever any purpose, would a crisis like that of the Savings & Loans, or the subprime crisis still occur? My personal answer is yes. Thus an ancillary question: what good is ethical finance?

* * *

In my new book, which incidentally came out yesterday: Misère de la pensée économique: “The Poverty of Economic Thought” (a pun on Karl Marx’ “The Poverty of Philosophy”, in its time a scathing critique of Proudhon’s “The Philosophy of Poverty”), I provide a detailed account of either faulty financial models or mistaken uses by financiers of essentially correct financial models. The added-value as I see it of the examples I’m providing in that book is that they’re not proposing broad abstract considerations about what may go wrong in a world paved with good intentions but show what happened in actual instances within firms caught in the turmoil of a landmark financial crisis.

As I explain in my book, there was a sequence of events where in the initial period of plenty nobody cared much about the accuracy of the financial models we were using as the profit margin on our dealings could actually accommodate any amount of error, while in the later period of hardship every player was running for cover and questions were all of a sudden raised, which had never been before, about how it was at all possible that we had lived comfortably with such lemons and not bothered at all.

There is a tendency nowadays to imagine that a prudential environment is the only way to go and that, should prudence not be implementable for circumstantial or more fundamental reasons, financiers would abstain to act. This is in no way the case: if a financial activity shows to be profitable – even if only at times – financiers will go for it. Whatever, that is, the amount and quality of modelling available at the time to offer an accurate view of the risk being taken. If models should at all be shown to quieten regulators, they will indeed be manufactured with little concern about their plausibility: the issues at hand will be simplified, stylized as much as needed, until they fit into some existing model. The famous Black & Scholes model for the pricing of financial options was borrowed from physics where in this prior incarnation it applied to the diffusion of gas. It never worked. I have shown – convincingly I believe – that it lacks one variable (Jorion 2010: 260-263; 2012: 98-106). Nobody cared though: one state variable was transmogrified into a control variable so that a pretence that the model worked could be staged to all stakeholders’ entire satisfaction.

The community has stepped in in recent times when the financial sector collapsed on the general assumption I imagine that the leaders of that sector had done as much as they reasonably could to prevent it from collapsing. But if the truth is that they can’t care less about collapse and act as they do even in the absence of any fair risk assessment, on the more trivial and straightforward assumption that there is a profit to be made, and if, in addition, they claim, along with Milton Friedman that they are only concerned about their investors and have no regard for either their clients or employees, then the question should be raised why the community should rush to their rescue whenever things turn sour, as the end result cannot fail then to be the only too familiar and infamous privatization of profits, socialization of losses.

The justification for bail-outs in the recent period has been as one knows “Too Big To Fail”: the loss to the community if such so-called systemic institutions were allowed to default would be so huge that their rescue when needed is but a small price for all taxpayers to pay. The moral of the story was drawn right away during the last term of 2008: systemic firms should be dismantled to the effect of creating units of such size that systemic risk due to their operations has been removed. If no measure of the kind was ever taken it is not that the underlying reasoning was ever shown to be erroneous, it is just that the clout of these firms, the weight which is theirs in the political process, has allowed them to prevent such measures from being taken at all.

I mentioned earlier that when the money market, the capital market for short-term debt instruments collapsed at the autumn of 2008, the cost for the community was close to one trillion dollars. The SEC, the Security and Exchange Committee of the United States, the regulator of most of the American financial markets, worked for three years to devise methods that would make a collapse of that kind nearly impossible in the future. In August of this year, it had finished its work and the proposed measures were ready to be put to the vote within its own board. It was known that the firms on the money markets regarded the implications of the new regulation as expensive for their business. They had lobbied for three years to prevent the approval of these rules and on the day their lobbying proved to have been effective as no majority was found on the SEC’s board to further pursue the implementation of the painstakingly designed prospective measures.

What this means is that the next time around a crisis develops on the money markets their collapse will take the exact same course if not worse than at the Autumn of 2008.

Will we ever learn from our errors? In fact we do, unfortunately those of us who learn from our errors hold a weaker lobbying power than those who don’t and for whom the notion of a « stewardship » of finance is, to use Friedrich Von Hayek’s words: « meaningless ».

My father who was a law professor at the Vrije Universiteit Brussel’s sister institution, the Université Libre de Bruxelles, was in his early career a lawyer. One of his clients came one day inquiring about how to handle a very minor affair. My father asked him if he had ever considered raising his voice, or even thumping with his fist on the table during the two parties’ endless debates. The man had not. He came back one day saying: « I did it and it worked! It would never have crossed my mind! » Maybe the time has come for us to thump on the table and say in a clear voice: « Enough is enough! »

References:

Bailey, Fenton, The Junk Bond Revolution, London: Mandarin, 1991

Black , William K., The Best Way to Rob a Bank Is to Own One, Austin: The University of Texas Press, 2005

Fabozzi, Frank J. & Franco Modigliani, Mortgage & Mortgage-Based Securities Markets, Boston: Harvard Business School Press, 1992

Fabozzi, Frank J., Franco Modigliani and Michael Ferri, Foundations of Financial Markets and Institutions, Flows, Englewood Cliffs (N.J.): Prentice-Hall, 1994

Friedman, Milton, “The Social Responsibility of Business is to Increase its Profits”, The New York Times Magazine, September 13, 1970.

“Milton Friedman, A heavyweight champ, at five foot two. The legacy of Milton Friedman, a giant among economists”, The Economist, November 23rd, 2006, http://www.economist.com/node/8313925?story_id=8313925

Leclerc-Olive, Michèle, « Ethique et finance. Du marché à l’espace public », IRIS-EHESS Séminaire « Finance, éthique et société », le 6 octobre 2011

Murray, Charles, “Why Capitalism Has an Image Problem”, The Wall Street Journal, July 27, 2012, http://online.wsj.com/article/SB10000872396390443931404577549223178294822.html

The UK Stewardship Code, http://www.frc.org.uk/corporate/investorgovernance.cfm

van Horne, James C., Financial Market Rates and Flows, Englewood Cliffs (N.J.): Prentice-Hall, 1994

22 réponses à “Chaire « Stewardship of Finance », leçon inaugurale : Why Stewardship of Finance?, le 4 octobre 2012”

Ah ouais, quand même, « c’est du sport ! »

Et moi qui pensais que vous improvisiez tout le temps. Là enfin, vous nous enlevez le doute.

« Lorsque, à l’automne de 2011 j’ai été approché par Michel Flamée au nom de la Vrije Universiteit Brussel… » Oui l’automne… est toujours une belle saison, pour faire des rencontres. C’est en automne que les oiseaux vont, se regroupant sur les fils, à des endroits précis et nous disent que l’hiver est proche. Toutes les oiseaux ne sont pas sédentaires et ceux qui partent en voyage ont de « bonnes raisons » d’écouter l’instinct de survie de leur espèce. Fuir l’hiver, plutôt que de s’adapter aux changements climatiques, telle est l’option qu’ont choisie ces oiseaux voyageurs. Ceux qui restent, en revanche, sont ceux qui ont appris à diversifier leur nourriture au fil des siècles. Car pendant que nous parlons des menaces sur notre propre survie, cette lutte a déjà commencé, touchant de nombreuses espèces d’oiseaux. Aujourd’hui, dans le monde, un oiseau sur huit est en danger d’extinction. Enfin tout comme l’abeille, l’oiseau migrateur est un excellent bio-indicateur, sur les changements et la qualité de l’air…

Mais au fait, quelle était la question ? Ah oui !

« Why Stewardship of Finance? »

« Finance éthique », « Finance responsable », « Finance durable» : Autant d’autres « phases climatiques » en perspective ??!…

Vont avoir du pain sur la planche, vos étudiants !

Je me demande si vous accepteriez le prix Nobel s’il vous était proposé dans un futur pas trop lointain

évidemment, rêve secret, il n’est pas homme à se cacher dans sa tanière ; mais le nobéliser serait de la dynamite, Nobel d’une nouvelle noblesse, plus proche de Don Quichotte, en rupture avec la cupidité. Que ferait-il du magot ??

le Nobel , belle manière pour le recupérer et le transformer en chien de garde .

Are central banks « socially useful », then?

Quelques commentaires et questions :

1. Les citations de Friedman et de Hayek me peinent, parce qu’il me semble que leur teneur polémique tient en grande partie au fait qu’elle ont été abstraites de leur contexte :

A. Pour la phrase de Milton Friedman, le contexte générale de la guerre froide et de l’affrontement à mort de deux blocs idéologiques ne peut pas être ignoré. Par ailleurs, considérer cette phrase comme fausse en soi, suppose implicitement de cautionner sa contraposée, qui me paraît au môns aussi odieuse – qu’en pensez vous ?

B. Pour la phrase de Hayek, le corpus philosophique libéral, qui considère qu’il existe des droits inaliénables démocratiquement, ce qui explique

a. que les pouvoirs dont dispose un gouvernement central étant de ce fait extrêmement limité dans un système libéral, la question de savoir qui d’une démocratie ou d’un dictateur se les partage est largement indifférente – un « dictateur libéral » n’aurait de toute façon aucun pouvoir réel, s’il est libéral.

b. qu’une démocratie peut être potentiellement dictatoriale si elle s’avise de toucher à ces droits inaliénables, comme l’a assez bien montré Tocqueville.

Soit dit en passant, je n’aurais cautionné aucune de ces phrases (et qu’on ne m’impute pas la (2-A-a), je ne fais que retracer un cheminement intellectuel, merci ), ni même le comportement des deux nobels, mais je trouve dommage d’utiliser les mêmes procédés lorsqu’on polémique et lorsqu’on enseigne.

2. Vos analyses appliquées sont très souvent excellentes, par la variété de vos outils – et notamment votre analyse de la méconnaissance et de la mauvaise gestion du risque de notre système financier.

Pourtant, lorsque vous passez de l’analyse à la théorie, j’ai toujours l’impression que vous oubliez de donner à cette même notion de risque la place centrale qu’elle occupe, ce me semble à raison, dans la théorie financière actuelle.

Deux exemples :

1. Dans le # qui commence par « there exists however… » : il me semble que la seule notion de richesse créée est inapte à rendre compte d’un prêt court terme à un ménage. J’entends par là que s’il ne crée pas de richesse (encore qu’il satisfasse un besoin…), le prêteur prend néanmoins un risque et ne pas vouloir le rémunérer conduit logiquement à faire de l’Etat le seul acteur susceptible de vouloir lui en fournir, puisqu’on propose un placement risqué mais non rémunéré.

2. Dans votre phrase qui sur la formation d’un prix, quoique je ne sois pas du tout contre l’idée d’y introduire une dose de rapport de force, cela me semble, pour un produit financier, également regrettable de ne pas y intégrer un élément de risque anticipé.

D’une manière générale : pourquoi une telle mise à l’écart de la notion de risque ? Comment l’intégrez vous dans votre éthique ?

3. Je suis curieux, au vu de votre formation, que vous vous contentiez de discuter la morale telle que les économistes la définissent. J’entends par là qu’une grande partie de vos problématiques me semblent relever de la philosophie ou de la sociologie, et notamment du passage d’une société holiste/organique, dans laquelle une Morale (liée à un Père) s’impose d’elle même à une société soudée et s’autocontrôlant, à une société libérale, que la pluralité des morales et l’exercice des libertés atomisent.

Vous soulignez souvent, comme Durkheim, la question cruciale du lien social dans une société à solidarité mécanique. Or, j’ai parfois l’impression – mais je vous fais sans doute ici un procès d’intention, puisque je ne peux l’étayer, j’ai parfois l’impression, donc, que vous êtes nostalgiques d’une société de type holiste, sans voir le prix qu’y coûtait cette conscience du collectif, et le caractère irréversible du chemin parcouru depuis : Dieu est mort, et nous ne penserons jamais plus comme les quakers.

C’est tout pour aujourd’hui – je vous remercie au passage pour l’ensemble de votre blog, c’est une vraie chance pour ceux qui vous lisent que d’avoir accès à une telle quantité d’information.

Bien à vous,

00

Merci. Comme vous le savez, je ne considère pas von Hayek, Friedman, etc. comme des penseurs parmi d’autres mais comme des idéologues retors, dangereux et ayant beaucoup de sang sur les mains. Vous semblez de bonne foi dans votre admiration pour ces gredins, j’espère que les écailles vous tomberont des yeux.

Une leçon inaugurale ne fait qu’annoncer. Une définition de l’éthique a été proposée lors de la deuxième leçon. J’en ai repris une partie de l’argumentation dans mon billet : Finance et éthique : une approche pragmatique.

J’ai vécu dans de petites communautés, je n’ignore pas que la vie y est le plus souvent plus contrainte et plus brutale que dans les communautés plus vastes. De manière générale, je ne me fais une représentation idyllique de rien du tout 😉

Je crains que sur ce point là, vous ne soyez pas familier de mes écrits. Vous trouverez dans mon livre Le prix (2010), un chapitre théorique – mais illustré de très nombreux exemples, sur : « Rareté, risque, statut des personnes » (pp. 207-236) où il me semble que je situe ces questions dans un cadre neuf mais mieux adapté que celui des approches traditionnelles.

@ 00

Concernant Hayek et Friedman, c’est un point aveugle de Paul Jorion. Je suis entièrement d’accord avec vous, mais pourtant je crois qu’il est futile d’essayer de réfuter des anathèmes comme « sang sur les mains » et « fascistes en col blanc ». Cette rhétorique se discrédite elle-même, et les arguments rationnels sont mieux employés ailleurs.

Cdt,

GSF

Ce sont des ennemis déclarés du genre humain. L’une des choses que j’ai toujours regretté chez mes amis du MAUSS, c’est leur ton déférent envers von Hayek : ce personnage avait fait du mensonge, de la dissimulation, de la manipulation, sa stratégie. En le faisant, il a couru le risque d’être démasqué. Maintenant, c’est fait.

Gus, Aron ça te cause? Un putain de vrai libéral, uh? Un qui connaissait bien Hayek, au moins depuis le colloque Lippman. Un qui a utilisé et diffusé très tôt la contre-idéologie néolib des « pèlerino-montois » contre l’ideologie totalitaire communiste, uh?

Citation (ARON, R., 1997. Introduction à la philosophie politique, Paris, Le livre de poche, p127) :

Je répète si t’as pas bien lu : si l’on voulait, à l’époque moderne, avoir un système économique libéral tel que le souhaitent M. von Hayek ou M. Jacques Rueff, il faudrait la dictature politique.

C’est pas d’un anthropologue plus ou moins belge, plus ou moins ex financier, plus ou moins ex quaker ou ex gaucho, pas du Jorion, pas même du Foucault ou Rawls, c’est du Aron, Raymond de son p’tit nom, Gus..

Alors?

Ah ! belle pêche ! Une génération entière qui n’a même pas été capable de lire ce que ces gredins écrivaient.

Aron l’avait mieux lu que certains du Mauss dirait-on Paul…

Protégez moi de mes amis, etc, c’est vrai de tous cotés….

Gus,

Moralité : au pays des aveugles les Dmla, glaucomeux, cataracteux, etc, sont en quarantaine, les myopes en prison, les astigmates au goulag, les presbytes à Treblinka et les autres six pieds sous terre.

Des ennemis du genre humain, c’est exactement cela, merci Paul.

Les idéologues anarcho-libertariens, théorisant l’individualisme le plus abouti, la haine des autres qui sont autant de limites à leur ‘liberté’.

Les fascistes de demain bien sûr (et déjà d’aujourd’hui), où l’état totalitaire et centralisé est remplacé par l’association (temporaire) d’une multitude de petits tyrans aveugles, égoïstes et sanguinaires (pour cela pas besoin d’un couteau ou d’un crochet de boucher, la spéculation massive, l’accumulation des richesses et la confiscation de l’appareil répressif à leur profit suffit largement).

J’espère qu’il ne faudra pas attendre une déflagration mondiale ou un méga-génocide pour coller une nouvelle définition sur leurs agissements et les démasquer, à l’image de ce qui a été fait ici. Du travail pour un anthropologue, sociologue, économiste… 🙂

Où l’Histoire s’écrit devant nous….

Suis pas un exégète de qui que soit, mais voici un passage de René Passet sur Hayek (j’ai mis en gras des passages) :

« L’État a pour fonction d’assurer le respect et le bon fonctionnement des règles du jeu économique… sans intervenir dans le déroulement de celui-ci.

Assurer le respect des règles générales du groupe, car : « Les gens devront […] se plier à certaines règles conventionnelles, c’est-à-dire à des règles qui ne découlent pas seulement de leurs désirs […] mais qui soient normatives et leur disent ce qu’ils doivent faire ou ne pas faire. » Ces règles s’imposeront même à ceux que leur intérêts particuliers conduiraient à s’en détourner, comme le « passager clandestin » qu’il faudra « obliger à leur obéir car, bien que l’intérêt de chacun le pousserait à les violer, l’ordre général qui conditionne l’efficacité collective des actions ne s’instaurera que si ces règles sont généralement suivies ». »

René Passet, Les Grandes Représentations du monde et de l’économie à travers l’histoire, Arles, “Thesaurus” Actes Sud, 2012, p. 848 (Les liens qui libèrent, 2010)

Donc voilà quelqu’un qui glorifie l’ordre spontané, mais qui veut de toute force bloquer l’évolution des sociétés, empêcher l’émergence spontanée de nouvelles structures.

Les citations de Hayek sont tirées de Droit, législation et liberté. Et René Passet note en bas de page : « Ne retrouve-t-on pas ici, au-delà des intérêts individuels, cet intérêt général (rebaptisé « ordre général ») que Hayek a mis tant d’ardeur à récuser par ailleurs ? »

La manière dont vous structurez votre pensée, et le « C’est tout pour aujourd’hui » me laissent penser que vous êtes quelqu’un qui pourrait concurrencer notre hôte sur le haut d’une chaire universitaire.

A quoi bon se demander si Friedman ou Von Hayek,sont des penseurs dignes de considération ou pas, si Keynes offre un modèle de pensée digne de ce nom, si vous savez déjà comment nous penserons à l’avenir : »Dieu est mort, et nous ne penserons jamais plus comme des quakers »?

J’aime bien la conclusion avec Jorion Ze Father qui demande à son client-plaideur s’il a,bien usé de tous les moyens plus ou moins conventionnels à sa dispositions, i.e du haussement de voix au maltraitement de table, avant de se disposer à lui verser des honoraires possiblement superfétatoires… Un peu comme si un trader de chez GS demandait à un client volontaire/pigeon spontané s’il était vraiment disposé à perdre sa mise sur de l’Abacus contre John Paulson et son interlocuteur…

« Il est peut-être temps pour nous de taper du poing sur la table et de dire d’une voix claire : assez c’est assez! »

« Je l’ai fait et ça a marché! Ça ne me serait jamais venu à l’esprit! »

Vigneron

Voila un clou bien enfoncé! Un clou tète d’homme bien entendu !

ctrl-alt-sup,

Justement on parle de dictature politique ? Peux t-on m’expliquer les quelques interrogations légitimes ? Notamment sur le libre échange (ou « monnet » par exemple) ?

C’est à ne plus rien n’y comprendre…..

Les multinationales ne forment-elles pas des dictatures politiques indirectement ? Ne remplacent-elles pas les états au sens de structures décisionnelles ? Les cartels et multinationales ne sont-ils une souveraineté supra nationale économique dans la forme mais dans le fond politique ? C’est le monde marchand du libre échange par excellence ! Et il n’y a plus de contres pouvoirs qui sont capables d’imposer des échanges rationalisés, un respect de l’environnement, une justice sociale…..La politique est une continuation de l’économie. Donc, une structure (économique et politique) supranationale qui ne fera que conforter le modèle en place par l’éloignement des centres de décisions.

La finance, l’économie et la politique ont des liens étroits, c’est évident. Ces structures n’ont pas de notion de territorialité.

Si elles veulent alors elles disposent…….Sans respect des résidents, de l’environnement, de la démocratie,……

Vigneron, mais pourquoi alors défendre toujours nos banques, la grande distribution, les labo, la chimie, l’agro (ogm,…) ? On ne peut pas paraitre contre un système politique d’un coté mais en faire l’apologie indirectement de l’autre côté ! C’est un enfumage ?

exemple de questionnement : http://www.pauljorion.com/blog/?p=42969#comment-375657

ps : « être et paraître ? »

Et si t’apprenais à penser plutot que penser à apprendre (à danser le quadrille qui plus est), majorette miniature…

ctrl-alt-sup,

C’est votre réponse ?

Tapez sur F1(aide)…..Je ne peux plus rien pour vous !

@Paul Jorion :

Qu’on ne se méprenne pas, je ne les soutiens pas, mais face aux accusations de fascisme qui pleuvent ici à tout va, j’ai parfois l’impression qu’on est d’un optimisme démocratique absolument béat – comme si l’on oubliait qu’Hitler avait été démocratiquement élu, et que le communisme s’était fait au nom d’un idéal démocratique. Aimons la démocratie certes, comme le moins mauvais des régimes, mais n’en oublions pas ses critiques libéraux parfois avisés. Je préfère voir un Hayek réfuté par l’argumentation plus que par l’anathème, car au jeu de « qui a fait quoi » au XXème siècle, je crois qu’il resterait peu d’intellectuels (Sartre, Heidegger, Althusser,…) là où leur système peut encore conserver de son efficace.

D’autre part et je plaide coupable, comme je le notais plus haut, je lis souvent vos analyses appliquées sur ce même blog, dont j’apprécie les outils, mais je ne me suis jamais véritablement lancé dans l’un de vos ouvrages. Je comptais sur ces conférences pour avoir un aperçu plus systématique de votre pensée ; j’irai consulter le passage que vous mentionnez en bibliothèque.

@ Vigneron Qu’il existe une incompatibilité entre la démocratie et le capitalisme, c’est ce me semble l’un des topos de la pensée économique au XXème siècle (voir Schumpeter, même l’argumentation de Jorion ci dessus sur le taux d’intérêt). Le capitalisme n’a pu se perpétuer qu’avec des compromis sociaux qui sont autant d’entorses démocratiques au libéralisme économique pur et dur nécessaires à sa survie– et moi même soutien de ce système hybride et boiteux par une pensée de derrière bien Pascalienne, je regrette que l’incapacité de ceux qui nous gouvernent à nouer de nouveaux compris, « suicide » ce système et nous conduise sans doute bientôt à jeter le bébé avec l’eau du bain.

@ Antoine N’ayant pas fini d’être élève, je me vois mal donner des leçons à un professeur. A vrai dire, s’il était possible de revenir à une société holiste, le problème de la solidarité ne se poserait pas, car dans ce type de société, il n’en est pas un ; le défi, dont cette conférence, ce me semble, se fait l’écho, est de reconstruire de la solidarité dans une société dans lequel le libéralisme philosophique est un « fait » (reconnaissance de et attachement à l’existence d’une sphère privée indépendante de la sphère publique et de grande ampleur).